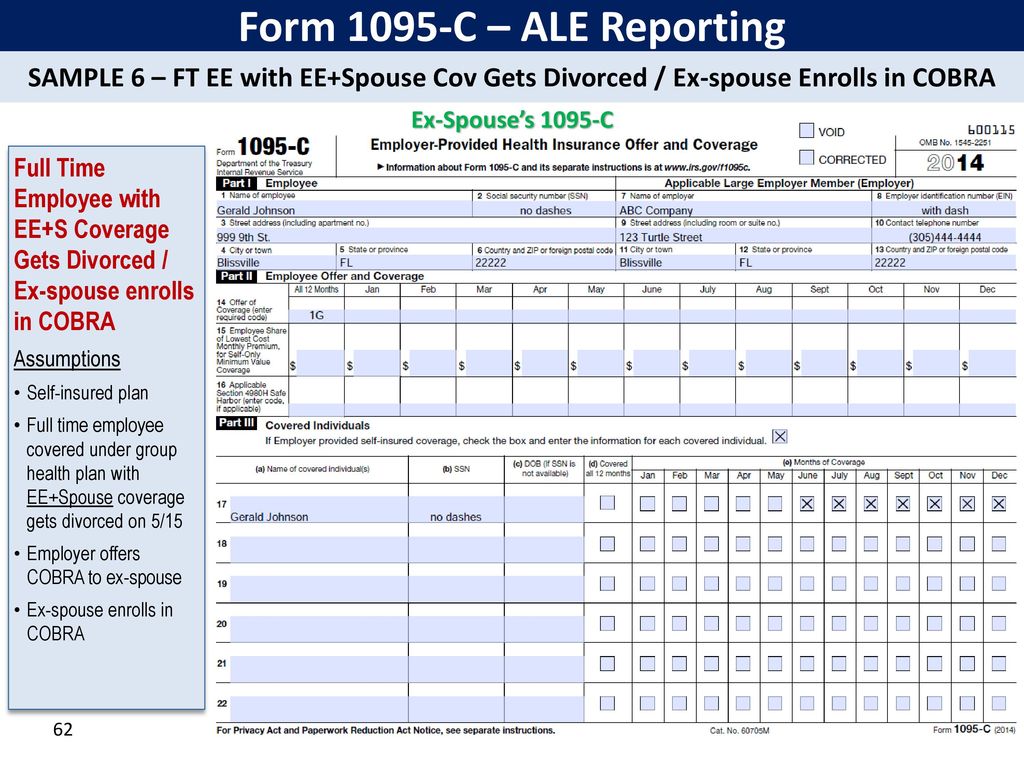

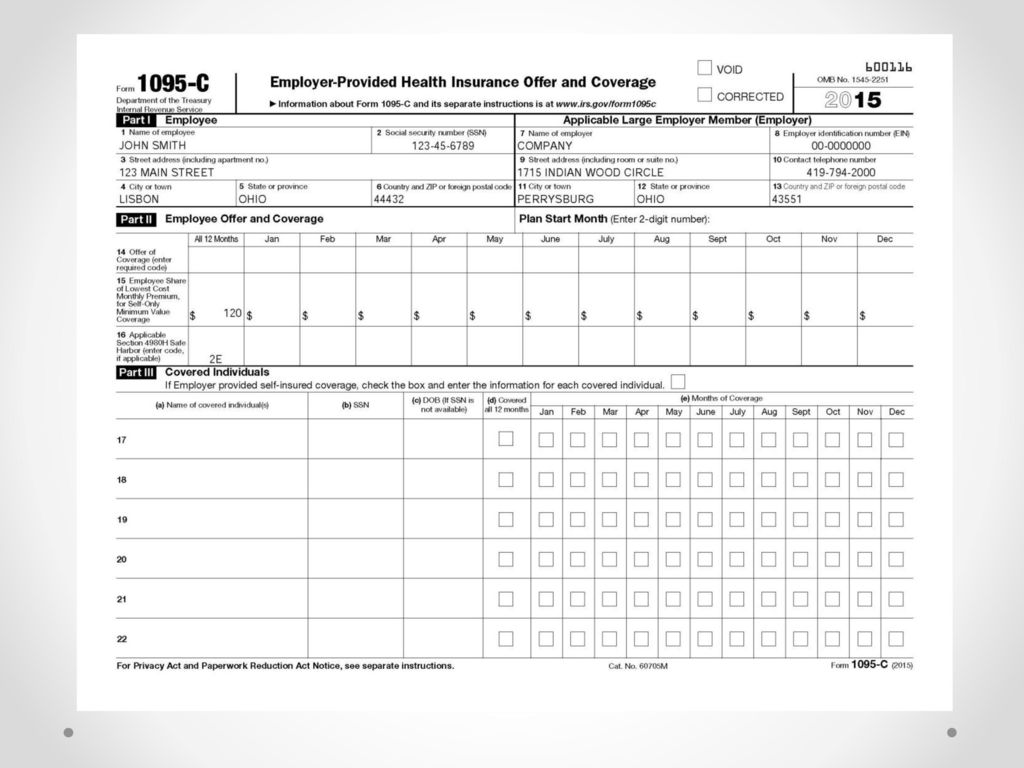

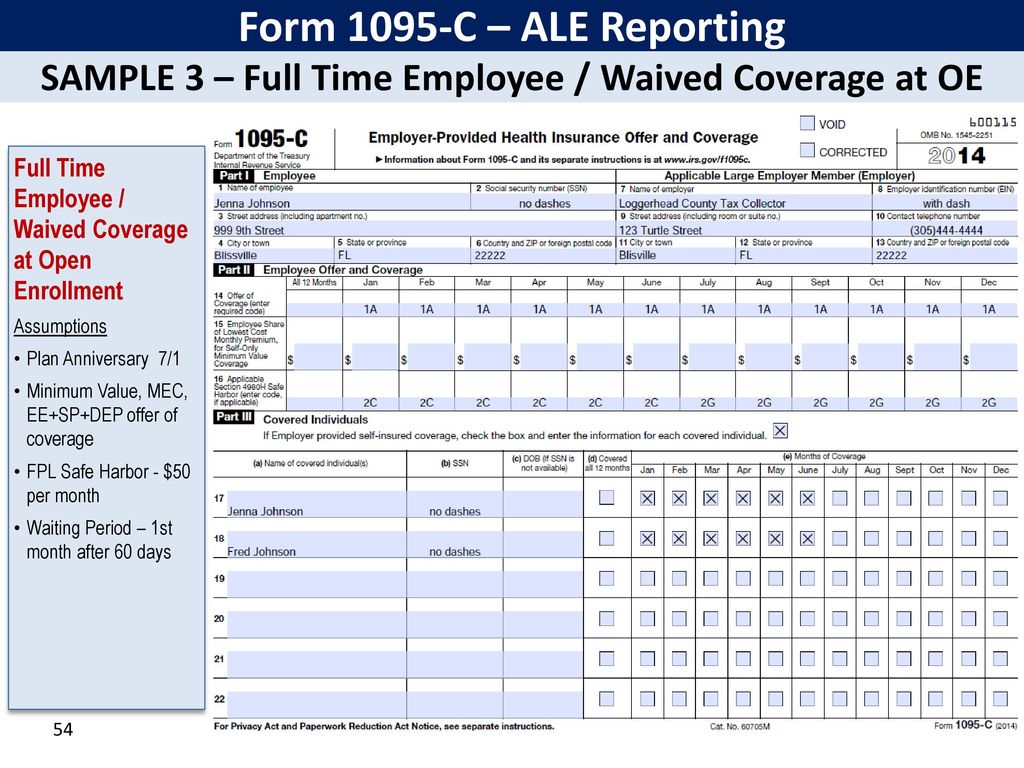

Form 1095C IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit For the 1095C, you only need to check the "Corrected" box on the form with the error, but you need to send it in with the 1094C — just don't check "Corrected" on that document Also, make sure you send your team the updated version as well 10 Your team doesn't have to do anything We're seriousNote that substitute forms may be used, but the substitute forms must include all of the information required by Forms 1094C and 1095C and must satisfy all of the IRS's form and content requirements Forms 1094B and 1095B are to be used by a small selfinsured employer that is not an ALE for Section 6055 purposes

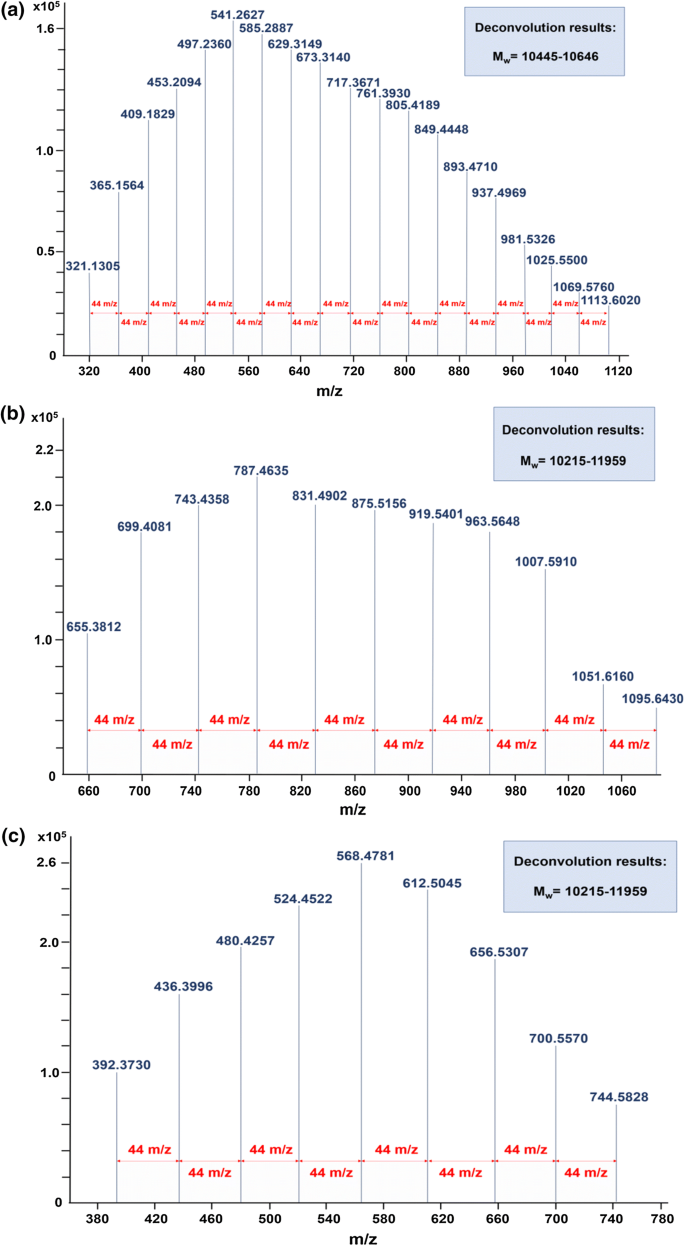

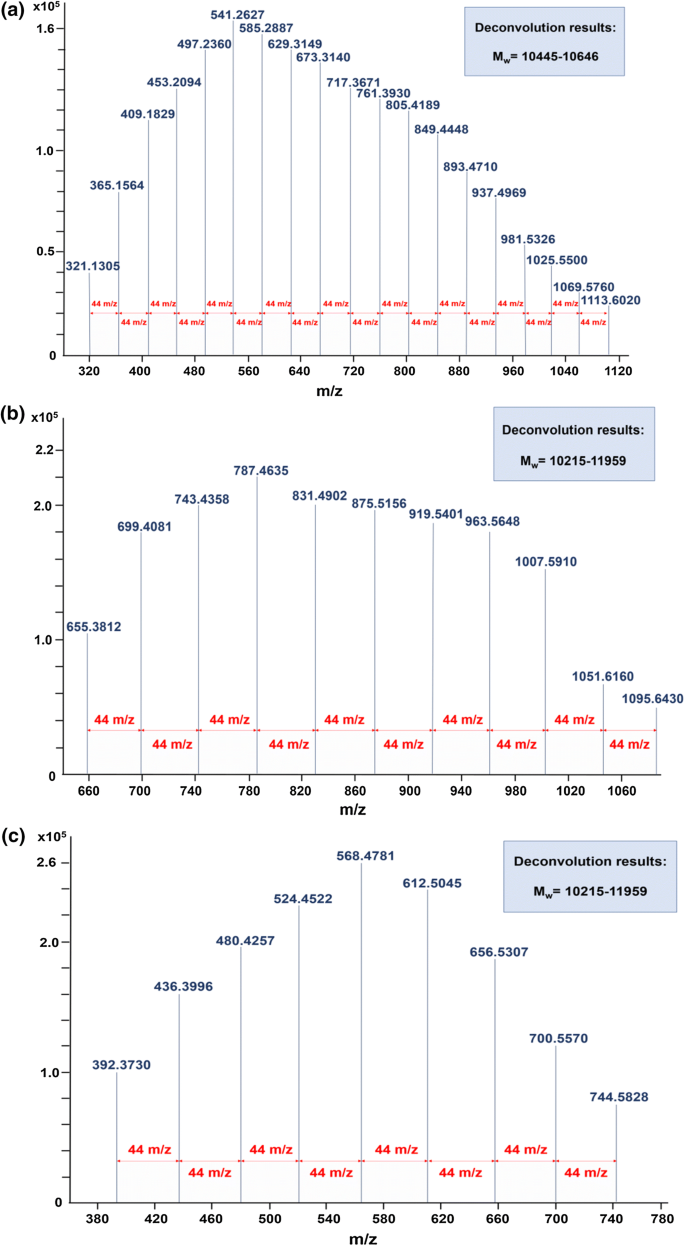

The Potential Of Lc Ms Technique In Direct Analysis Of Perfume Content Springerlink

How to use 1095-c

How to use 1095-c-Creating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample 61 Form 1095C must be provided to the IRS by (filing electronically) Form 1095C must provided to the IRS by Feb 28, 17 (filing paper) 62 I am probably going to need an extension on that one too 62 63 Form 09 is for you then 63 64

Differential Gene Expression Between Polymorphic Zooids Of The Marine Bryozoan Bugulina Stolonifera G3 Genes Genomes Genetics

FullTime Employee Hired Midyear;Data, put and ask for legallybinding electronic signatures Do the job from any gadget and share docs by email or fax Check out now?FullTime Employee Hired Midyear, Qualifying offer;

Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingFullTime Employee Waived Coverage All 12 Months;Sample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19

*Updated for tax year 16 In January, aside from receiving your usual Form W2 from your employer, you may receive Form 1095C related to the Affordable Care Act (ACA) If you received health insurance outside of the marketplace exchanges in and worked for a large employer, look for Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14There are several different reasonable causes for failing to file 1094C and 1095C forms For example, fire, natural disaster, and casualty are all considered reasonable causes However, concrete proof that a reasonable cause occurred must be provided to the IRS in order to have the penalties waived

Aca Code Cheatsheet

Sample 1095 C Forms Aca Track Support

PartTime Employee Becomes FullTime MidyearFor example, if you changed jobs in this tax year and were enrolled in coverage with both employers, you should receive a 1095C from each employer Or, if you work for an employer with different franchises or companies, you may receive a 1095C from each companyForm 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out by the

New Form 1095 B 17 Models Form Ideas

Form 1095 C Template Shefalitayal

The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment According to the ACA, certain companies must provide an option for health insurance to their employees if the companies are ApplicableLine 14 of Form 1095C is used to report information about the coverage offered throughout the year The offer of coverage made to an employee for each month of the year includes health insurance coverage offered or not and the type of coverage The IRS has designed sets of codes 1A to 1K which describes the offer of coverageApplicable Large Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment with another Applicable Large Employer) In that situation, each Form 1095C would have information only about the health insurance coverage offered to you by the employer identified on the form

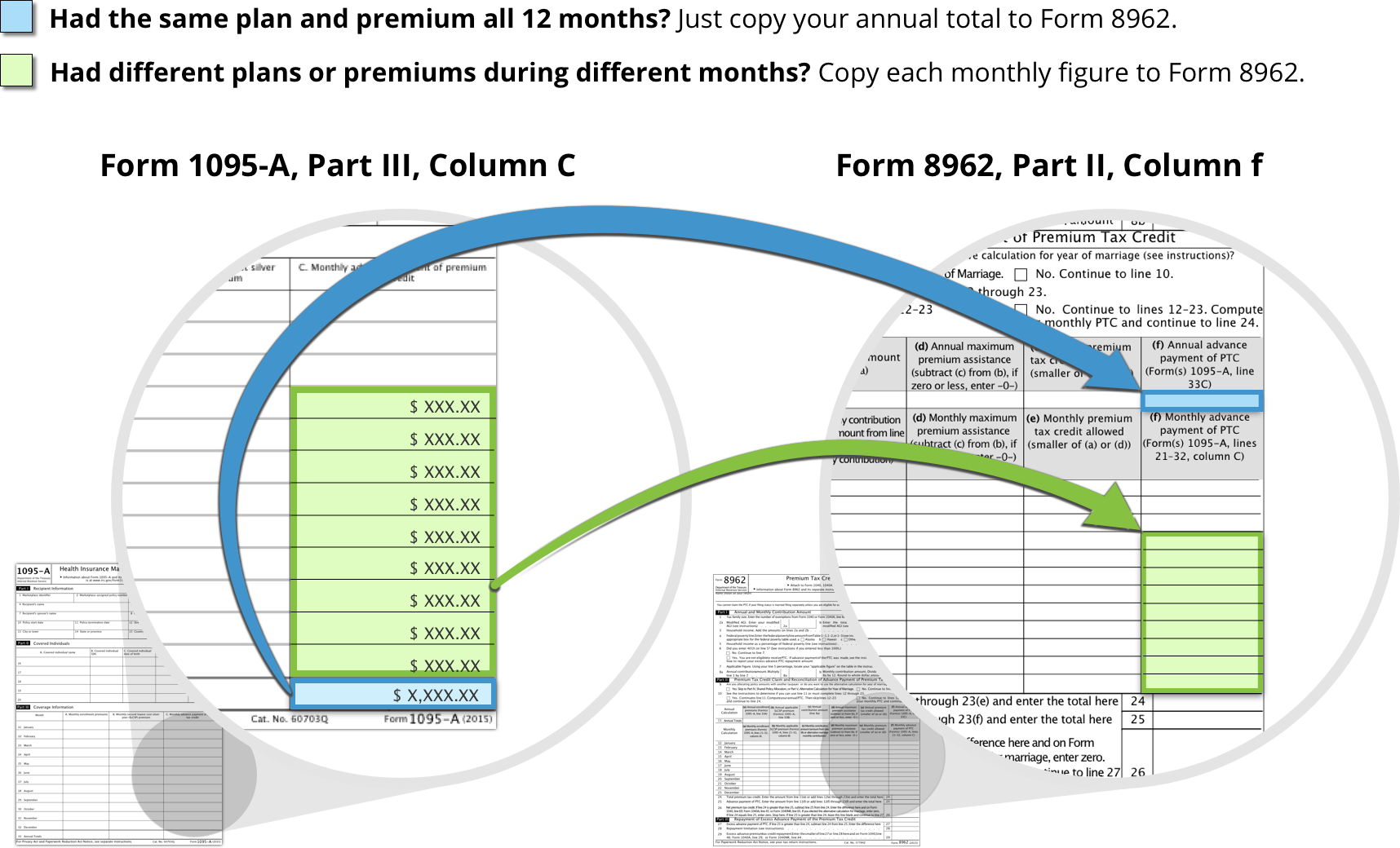

How To Reconcile Your Premium Tax Credit Healthcare Gov

Index Of Forms

All fulltime employees at companies with more than 50 fulltime employees will now receive a Form 1095C to report health care coverage offered by their empB1 Understanding the Sources for Forms 1095C and 1094C and1095C XML The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information to The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines

1

Publication 974 Premium Tax Credit Ptc Internal Revenue Service

Form 1095C is the IRS form employers provide to their employees detailing employerbased health coverage they received during that calendar year Every applicable large employer (ALE) needs to furnish a Form 1095C to each employee with information about their medical benefits for reporting purposes The ACA Form 1095C, EmployerProvided Health Insurance Offer and Coverage is used by applicable large employers (Employers with 50 employees) to report their employees' health coverage information with the IRS The IRS uses the information on the Form 1095C to determine the following1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage (for selfonly minimum essential coverage Information about Form 1095C and its separate instructions is at wwwirsgov/form1095c OMB No 15 share of the lowestcost monthly premium Part I Employee

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

The Codes On Form 1095 C Explained The Aca Times

Key Points about completing Form 1095C You have until to deliver Form 1095C to your employees The codes you use to complete these forms depend on the coverage you offer, whether your employee enrolls, and other employment changes We outline common example scenarios to help you choose the appropriate codes for lines 14 and 16Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more What is Form 1095C?

Aca Code Cheatsheet

1

Mark the checkbox for each client for which you want to export a template spreadsheet If necessary, click the Ellipsis button in the Client Options column to specify filtering and sorting options for the employees Click OK when finishedForm 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee Current Revision Form 1095C PDF1095c examples Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Turn them into templates for multiple use, add fillable fields to gather recipients?

2

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

In this case, the employee's 1095C form will show their insurance status up to their termination month, and then change to a 1H/2A (No Offer of Coverage/NotEmployed) status for the remainder of the year In this example, the fulltime employee was insured from January through April, at which time they termed SelfInsured Plan 1095 C Form Example Form 0440 SHARE ON Twitter Facebook Google 21 Posts Related to 1095 C Form Example 1095 C Form Aca Form 1095 1095 C Form Codes 1095 C Form Instructions How Do I Print My 1095 A Form Print 1095 A Form Print 1095 A Tax Form Print Irs Form 1095 AThe Form 1095C includes information about the health insurance coverage offered to you and, if applicable, your family You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form (s) as a part of your personal tax filing

2

Vehi Org Client Media Files 02 Irs Reporting Webinar Vehi Resource Guide Overview 9 25 18 2a12 3 18 Pdf

Here are a few more questions from our webinar, "Mastering 1095C Forms for ACA Compliance" If you missed the webinar, you can replay it hereThese questions cover measurement and stability periods, Union questions, waiting periods, and specifics on the formsChoose File > Export > 1095C Data to open the Export 1095C Data screen; If they are fully insured, they get a 1095B from the insurer and fill out Sections I and II of 1095C Employers who have to file the forms will also need to file a 1094B or 1094C forms for Applicable Large Employer (ALE) requirements and to tell the IRS if you offered employees Minimum Essential Coverage (under PPACA section 6055 and section 6056)

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax returnIRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland singleForm 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated

1

Cobra Faq S For Employer Reporting Onedigital

FullTime Employee Enrolled All 12 Months;Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page; An example of a letter is proposed in the article below The official letters occupy a vital place in the world of the market It is essential to understand how to write an official letter Higher letter writing skills will allow you to write appropriate donation letters In March, you will receive your 1095C form

Oracle Workforce Rewards Cloud R13 Updates 18a 18c

Www Hubinternational Com Media Hub International Pdf Employee Benefits Aca Decoding Codes Pdf

Common 1095C Coverage Scenarios FullTime Employee Enrolled all 12 Months, qualifying offer; Form 1095C Employee Questions Answered 15 marks the first year applicable organizations are required by law to file Forms 1094C and 1095C As a result, many employers have spent the bulk of their time huddled away in offices learning the ins and outs of each form to ensure yearend filings meet the Internal Revenue Service'sCode Series 2 for Form 1095C, Line 16 Line 16 of IRS Form 1095C lists a code that describes, for each month in the previous year, the kind of coverage that an employee enrolled in, and how the employer meets the employer shared responsibility "Safe Harbor" provisions of Section 4980H Below is a description of the various codes in Code Series 2

390 Best W2 Forms Ideas In 21 W2 Forms Form Tax Forms

Ecfr 34 Cfr Part 668 Student Assistance General Provisions

This is "ACA Part 2 ACA 1095C Examples" by Ascentis Corporation on Vimeo, the home for high quality videos and the people who love themJohn Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning CircleForm 1095C Part II Filing Guide Answer the questions below to help you better understand what codes to enter in Lines 1417 of Form 1095C Please note that this information covers common scenarios and is not allinclusive IMPORTANT UPDATE As of , the IRS has added two new line 14 codes that are not reflected in this tool

Surfactant Coated Nanoparticles In Nanomedicine And Food Ijn

Oracle Workforce Rewards Cloud R13 Updates 18a 18c

Form 1095 C Employee Communication (50 Fully Insured Plan) HR360's sample letters include Explanations of why the employee is receiving Form 1095C Information included in the Form 1095C (including an explanation of Part III for selfinsured plans) Descriptions of why an employee may receive multiple Forms 1095C Enter code 2C for any month in which the employee enrolled for each day of the month in health coverage offered by the ALE Member, regardless of whether any other code in Code Series 2 might also apply (for example, the code for a section 4980H affordability safe harbor) except as provided below For example, if an employee is offered coverage for plans that begin in January and July, the employee's Form 1095C plan start month box should be completed with 01 If there is no plan under which coverage is offered to the employee, 00 should be entered in

Maximizing Premium Tax Credits For Self Employed Individuals

2

Generate and/or audit 1095C forms A full list of codes is available on our website 1095C Part II "Safe" Code Combinations Line 14 Line 16 Descriptive Examples 1A 2C FullTime employee, spouse, and dependents were offered MEC at Minimum Value The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information 1095c examples – Fill Online, Printable, Fillable Blank By admin 16 July, 21 No Comments 8 Mins Read Facebook Twitter LinkedIn Tumblr Email

Aca Resources You Won T Want To Miss Out On Kronos

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Example 1 ‐Full time & participating all year • Suzy Smith is a full time employee working for School District ABC, a large district participating in VEHI • Suzy is offered coverage and her spouse and dependents are eligible for the plan • Suzy

Retired Senior Volunteer Program Of Centre County Posts Facebook

2

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Form 1095 A 1095 B 1095 C And Instructions

2

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 16 03 Premium Tax Credit Tips And Tricks Pdf

Viral Epitope Profiling Of Covid 19 Patients Reveals Cross Reactivity And Correlates Of Severity Science

Epb1 Indene Compounds Google Patents

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Www Cigna Com Static Www Cigna Com Docs Employers Brokers Insights Informed On Reform Aso Ppaca Fees Reporting Resources Fact Sheet Pdf

2

2

Uva Health Plan Uva Hr

Publication 974 Premium Tax Credit Ptc Internal Revenue Service

Www Cchwebsites Com Content Pdf Tax Organizer Pdf

Inventory Accounting For Cannabis Businesses Sec 280e And The Impact Of Tax Reform

Deadlines Loom As Employers Prep For Aca Reporting In

2

Noncanonical Crrnas Derived From Host Transcripts Enable Multiplexable Rna Detection By Cas9 Science

Irs Health Coverage Reporting Form 1095 C Examples For Youtube

Cs Thomsonreuters Com Ua Ut Cs Us En Pdfs Sdeex Pdf

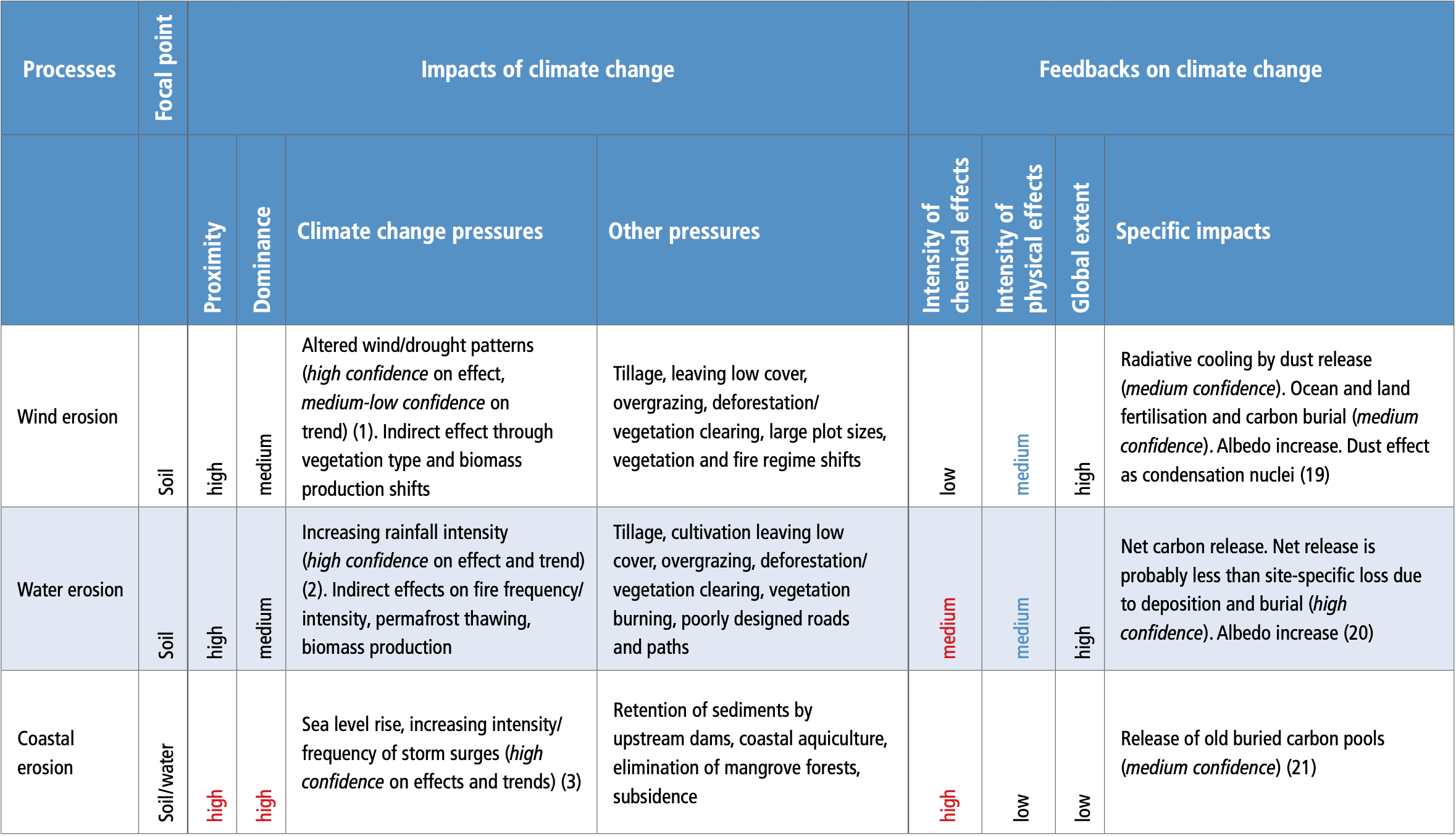

Chapter 4 Land Degradation Special Report On Climate Change And Land

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

1095 C Form 18 Awesome Examples Resumes 17 Basic Resume Model Gallery Resume Format Models Form Ideas

7 Faqs On Form 1095 A Health Insurance Marketplace

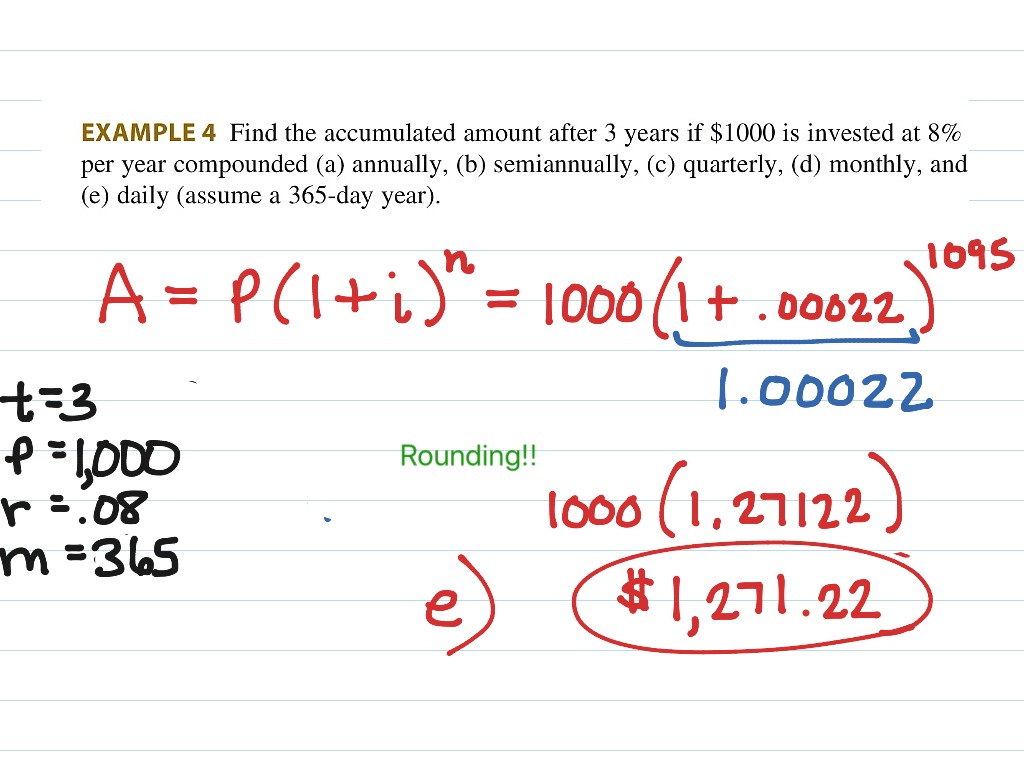

Compound Interest Example Multiple Compounding Periods Math Showme

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1095 A 1095 B 1095 C And Instructions

Srm Magic Ms Gov Sap Ebp Docserver Phioget Kpid ee5a6bd1afbb293e499 Kpclass p P Doc Sap Client 100 Addendum 3 Pdf

Employee Hr Lacounty Gov Wp Content Uploads 12 Final 21 Megaflex Spd Pdf

Www Whoi Edu Fileserver Do Id Pt 2 P 769

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

Form 1095 C Forms Human Resources Vanderbilt University

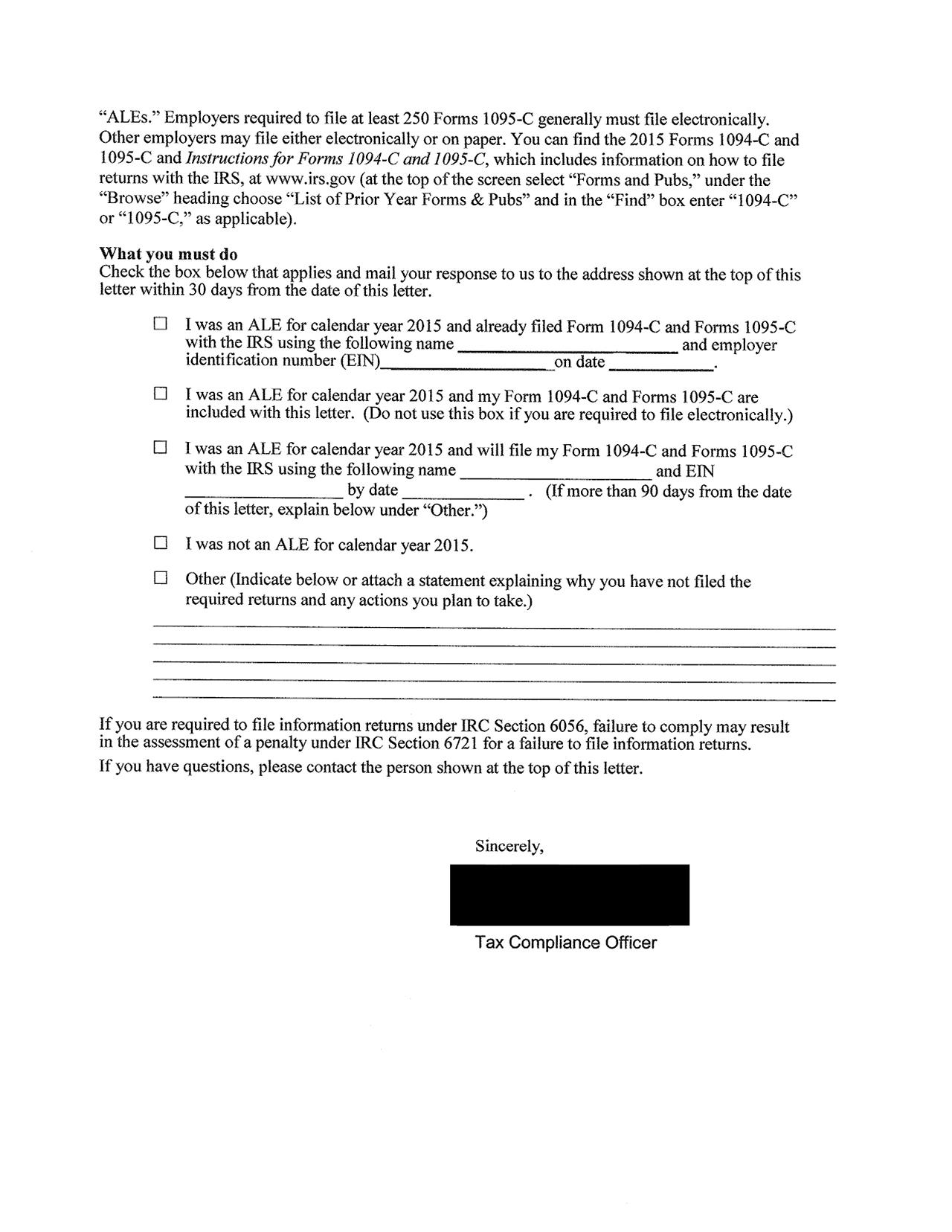

Cover Letter To Irs Sample Cover Letter

Www Schoolcare Org Uploads Files Video Transcript Irs Reporting Updates Part 2 Pdf

2

Maximizing Premium Tax Credits For Self Employed Individuals

Uva Health Plan Uva Hr

What You Need To Know About Filing Your Taxes Goodrx

The Affordable Care Act Upcoming Reporting Requirements Ppt Download

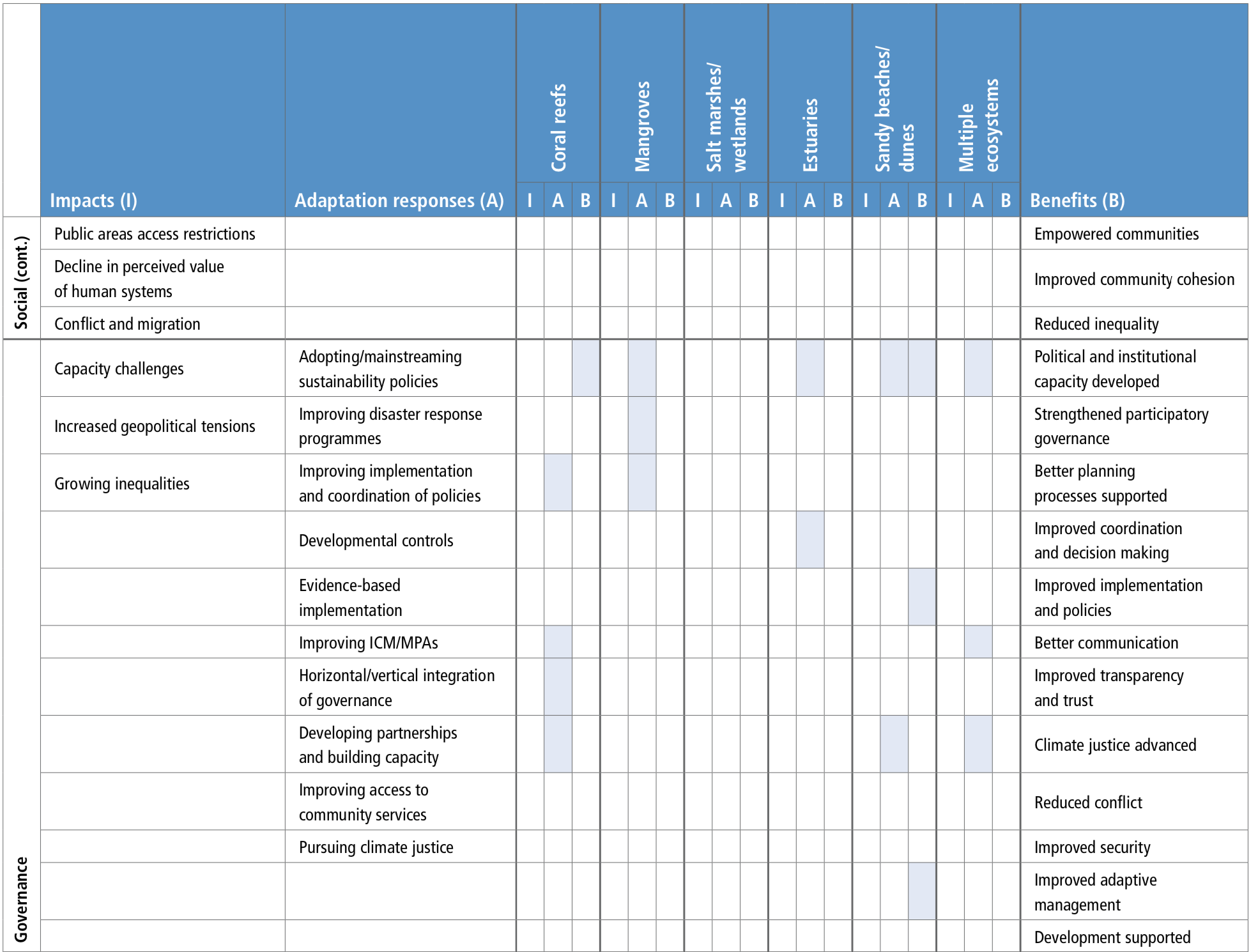

Chapter 5 Changing Ocean Marine Ecosystems And Dependent Communities Special Report On The Ocean And Cryosphere In A Changing Climate

The Potential Of Lc Ms Technique In Direct Analysis Of Perfume Content Springerlink

Does English Have Useful Syllable Division Patterns Kearns Reading Research Quarterly Wiley Online Library

1095 C Form 18 Awesome Examples Resumes 17 Basic Resume Model Gallery Resume Format Models Form Ideas

Federal Register Medicare Program Inpatient Rehabilitation Facility Irf Prospective Payment System For Federal Fiscal Year And Updates To The Irf Quality Reporting Program

Sample 1095 C Forms Aca Track Support

Differential Gene Expression Between Polymorphic Zooids Of The Marine Bryozoan Bugulina Stolonifera G3 Genes Genomes Genetics

Www Irs Gov Pub Irs Prior Ic 17 Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1

Year End Hr Checklist

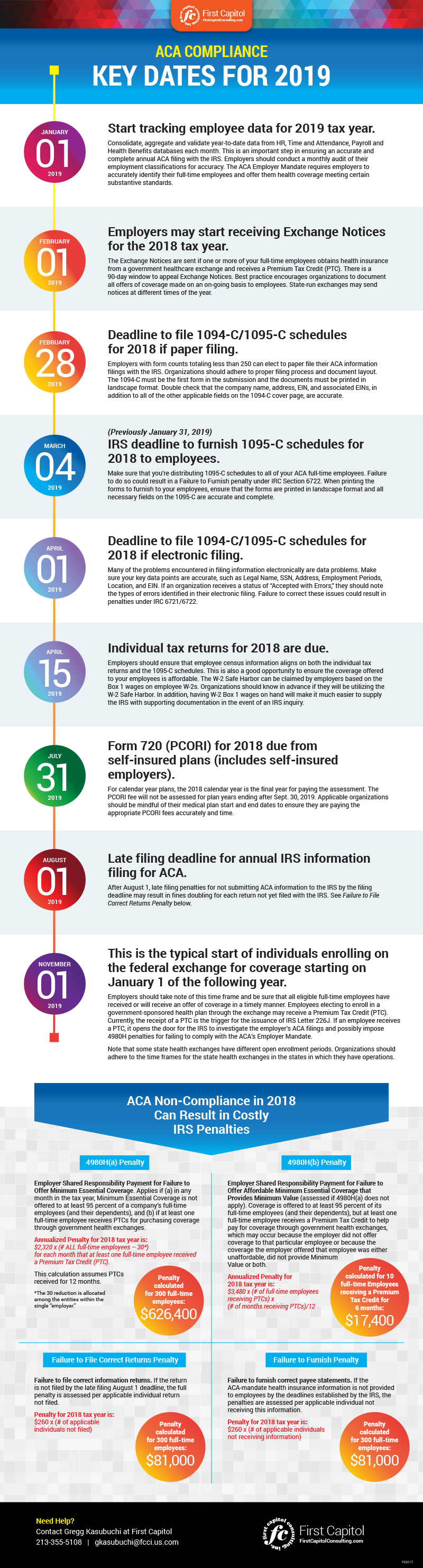

Mark These 19 Dates For 18 Aca Reporting Update The Aca Times

Previous Geochronology Of High Grade Rocks From The Mozambique Belt Of Download Table

Http Dbm Maryland Gov Benefits Documents Acataxformsemployee Pdf

Indirect Interactions In Terrestrial Plant Communities Emerging Patterns And Research Gaps Sotomayor 15 Ecosphere Wiley Online Library

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Sample 1095 C Forms Aca Track Support

Benefits Longmeadow Ma

Epa1 Indene Compounds Google Patents

What To Do When You Receive An Irs Audit Letter Atlanta Tax Lawyers

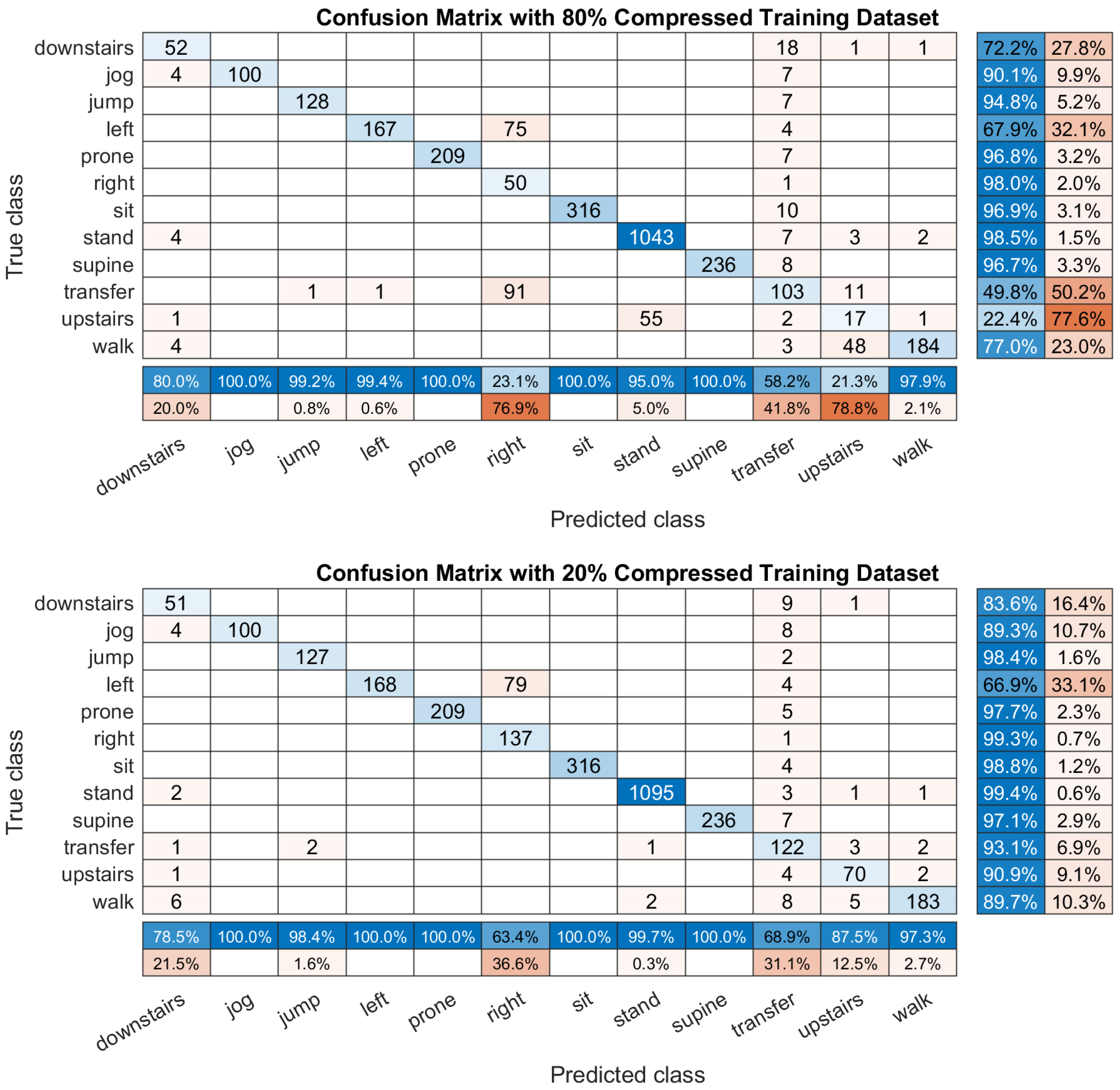

Sensors Free Full Text A Fast And Robust Deep Convolutional Neural Networks For Complex Human Activity Recognition Using Smartphone Html

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Deep Self Evolution Clustering

Human Phospho Hgfr C Met Duoset Ic Elisa Dyc2480 2 R D Systems

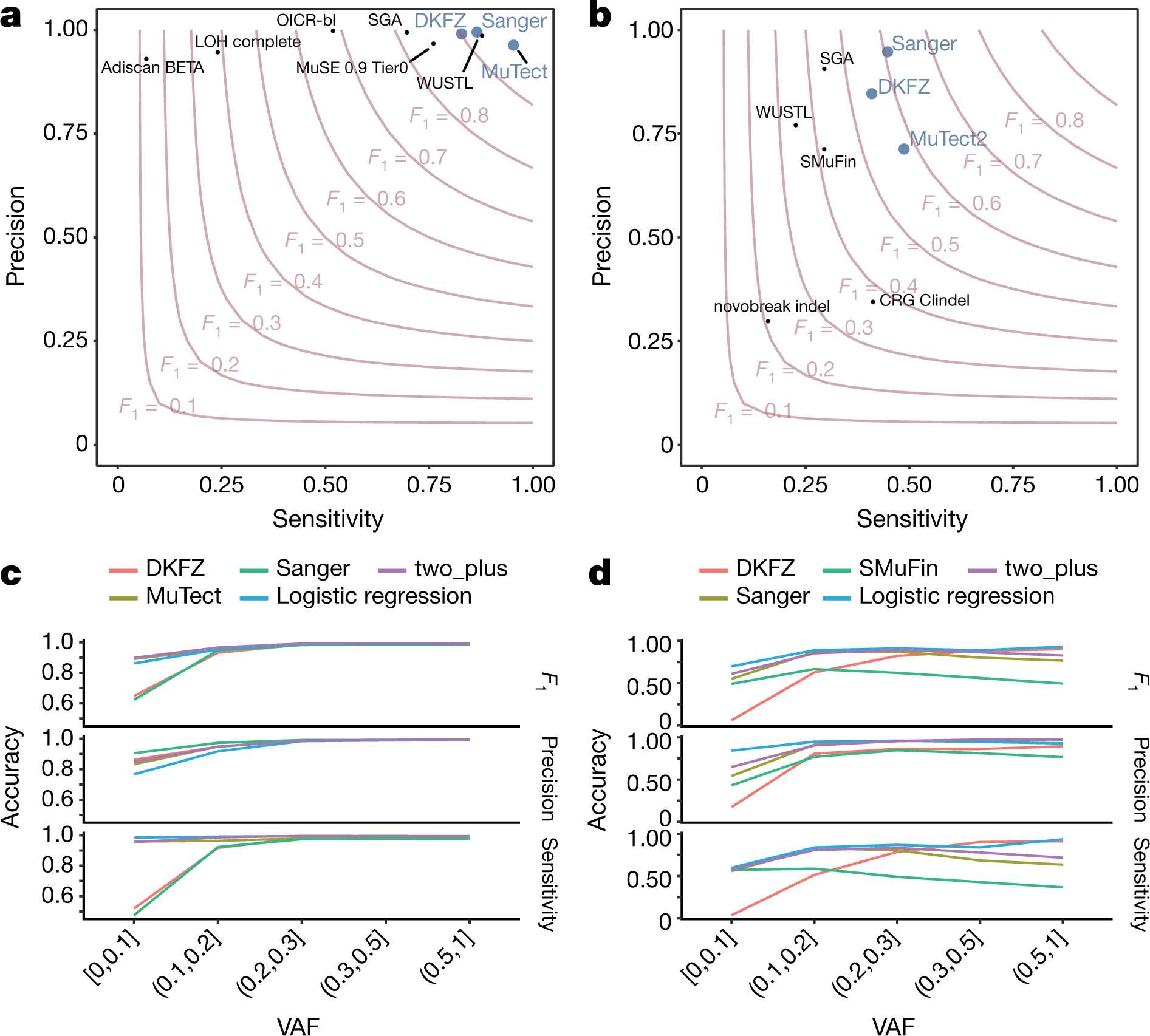

Pan Cancer Analysis Of Whole Genomes Nature

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1095 C 15 Pdf

2

Iso 19 Changes In The Current Version Of Iso Oriel Stat A Matrix Blog

How To Fill Out Obama Care 62 Premium Tax Credit Forms If Single Youtube

How To Fill Out And File Irs W2 C Form

Self Service For Students

Multisystem Inflammatory Syndrome In Children A Systematic Review Eclinicalmedicine

0 件のコメント:

コメントを投稿